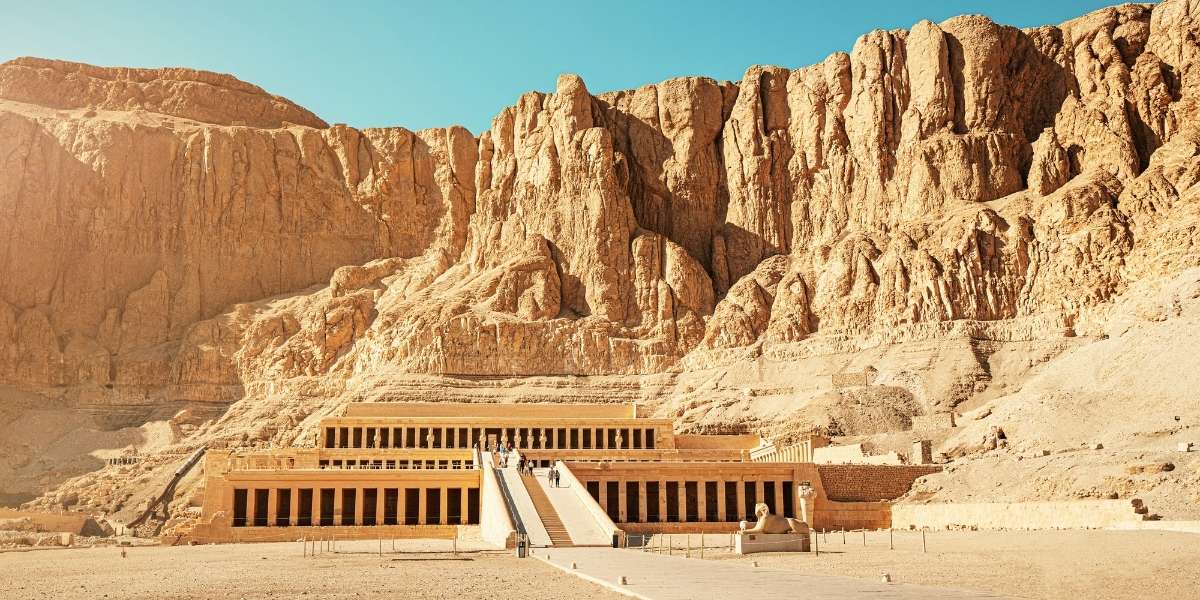

One World Trade Center: A Beacon of Strength

The Rise of One World Trade Center: A Symbol of Resilience The skyline of Lower Manhattan features a prominent structure that stands tall as more than just a skyscraper. One World Trade Center is a powerful symbol of endurance, a testament to collective resolve, and a beacon of hope that

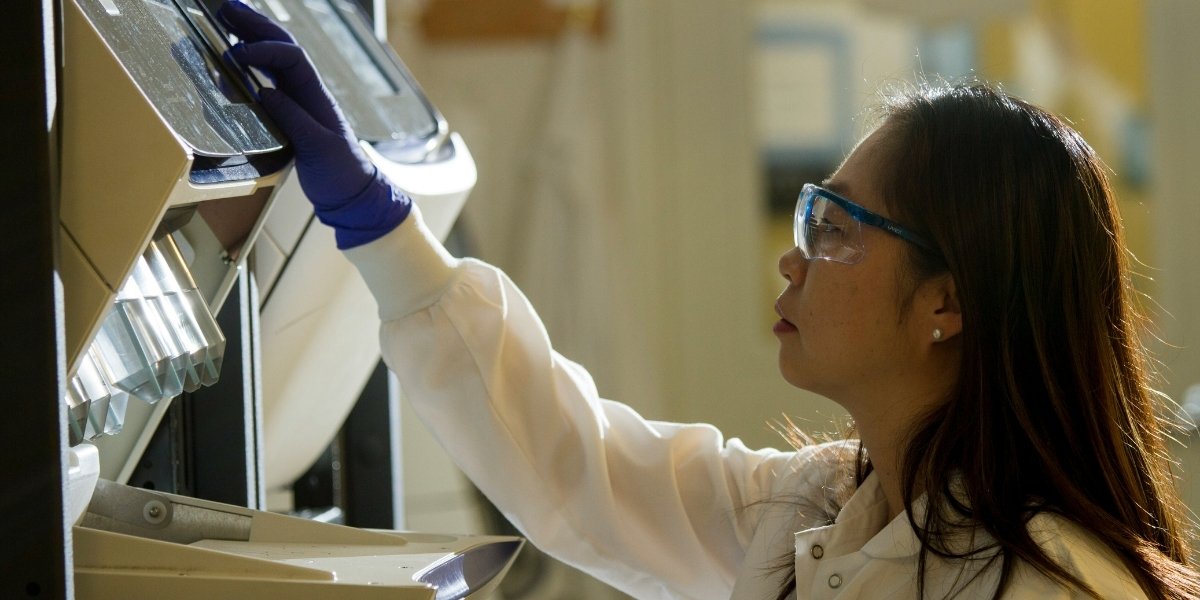

![The Powerful Partnership Between Business and Science[a][b]](https://nashvilletimes.com/wp-content/uploads/2024/11/the-powerful-partnership-between-business-and-science-a-b-featured-image.png)